The 3 Best Budgeting Apps for Students in 2025 (Free & Paid)

💡 Quick Summary: Best Student Budgeting Apps 2025

| App | Best For | Free Plan? | Link |

|---|---|---|---|

| Rocket Money | Canceling unused bills | ✅ | Try Rocket Money Free |

| Empower | AI-based spending insights | ✅ | Download Empower |

| YNAB | Deep budgeting strategy | ❌ 34-day free trial | Try YNAB |

Why Every Student Needs a Budgeting App in 2025

Struggling to manage your money in college? You’re not alone. Between tuition, food, and random subscriptions that won’t quit, budgeting can feel impossible — unless you’ve got the right app.

We tested the most popular money apps for U.S. students in 2025 — and picked the top 3 that actually work (and don’t overwhelm you).

🎯 Short on time? Here’s the winner:

✅ Rocket Money — Best overall app to track and cancel subscriptions instantly.

Looking for the best student budgeting apps 2025? You’ve come to the right place!

Why Students Need a Budgeting App (That Doesn’t Suck)

Finding the best student budgeting apps 2025 can be a game changer for managing expenses effectively.

Most budgeting apps are:

- Built for adults with full-time salaries

- Too complicated for real life

- Overloaded with categories you’ll never use

Students need something different:

- Simple interface

- Cancel button for trials and forgotten subscriptions

- Automatic saving options

- Works on low-income or variable income

These 3 apps do all of that — and more.

Want to save $100/month without lifting a finger? Try Rocket Money free today.

🥇 Rocket Money: Best for Passive Budgeting + Subscription Canceling

If you’re the kind of student who doesn’t want to manually track every dollar, Rocket Money is your lifesaver. Key Features

- Cancels unused subscriptions automatically

- Tracks spending across all your bank accounts

- Alerts you when you’re overspending

- Offers bill negotiation (they’ll lower your phone bill — seriously)

Why It’s Great for Students

- Most students forget they’re still paying for Netflix or random iPhone apps

- This tool can instantly free up $50–$150/month

- One dashboard = total financial visibility

Pros

- Set-it-and-forget-it style budgeting

- Great mobile app UX

- You only pay a cut of what they save you (optional)

Cons

- Less customizable for budgeting categories

- Limited manual controls compared to YNAB

✅ Start with Rocket Money — Free Setup

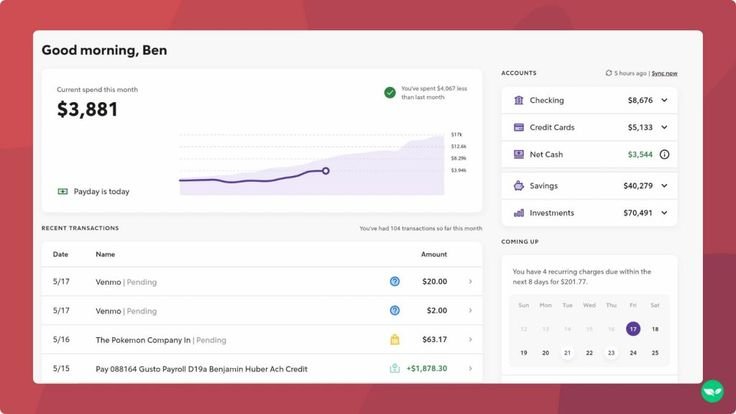

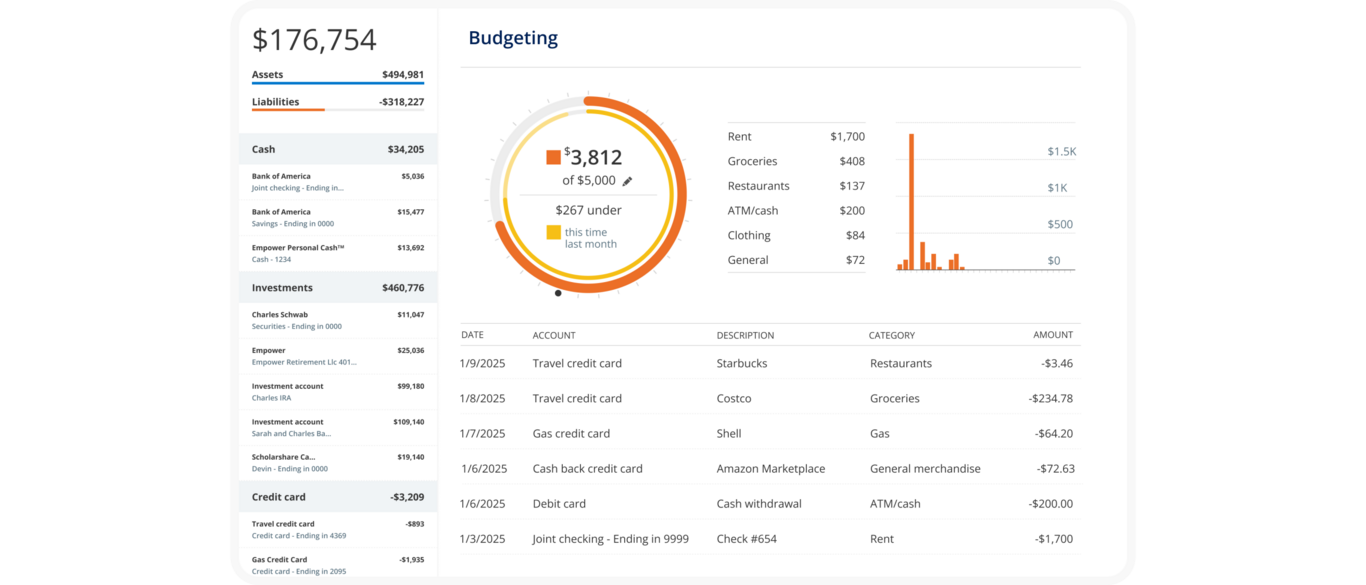

Empower: Best for AI-Powered Insights + Smart Spend Tracking

If you want a more active budgeting experience with AI assistance, Empower is built for you.

Key Features

- Daily spend alerts based on your habits

- Automatically categorizes expenses

- Personal AI assistant helps make smarter choices

- Lets you set saving goals and monitor your progress

Why Students Love It

- It makes budgeting feel modern, like your own financial coach

- You’ll stop overspending on small things like snacks and rideshares

Pros

- Slick mobile interface

- Smart alerts and suggestions

- Motivates savings with gamified progress

Cons

- Less automated cancelation features than Rocket Money

- Budgeting feels less hands-on

Compare: Rocket Money vs Empower — Which Saves You More?

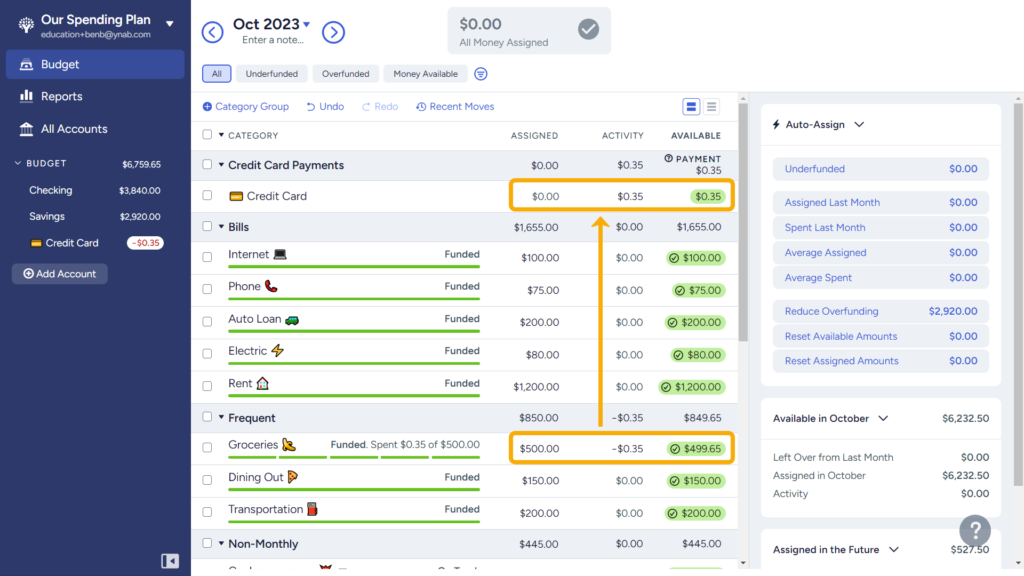

🥉 YNAB: Best for Budget Nerds Who Like Control

For the spreadsheet lovers or those who want every dollar assigned a job, You Need A Budget (YNAB) is for you.

🔍 Key Features

- Proactive budgeting: plan every dollar before you spend it

- “Age your money” feature teaches better habits

- Syncs with your bank accounts

Why Students Might Use It

With the best student budgeting apps 2025, students can easily see where their money goes each month.

- Great for Type-A personalities

- Useful for students with part-time jobs, financial aid, or side gigs

Pros

- Full control over budgeting categories

- Encourages saving ahead of time

Cons

- Steeper learning curve

- Paid only after free trial

✅ Try YNAB Free for 34 Days

How to Choose the Right Budgeting App for Your Student Lifestyle

Choosing the right app depends on how involved you want to be.

| Lifestyle Type | Best App Choice |

| I want to set and forget it | Rocket Money |

| I want alerts and coaching | Empower |

| I want full control + goals | YNAB |

Ask yourself:

- Do I want the app to do most of the work for me?

- Am I a visual learner who likes insights?

- Do I already use a spreadsheet?

The more control you want, the more YNAB makes sense. But for most, Rocket Money is the easiest win.

What to Avoid When Picking a Budgeting App

Here are red flags to watch out for:

- Apps that don’t sync with your U.S. bank account

- Tools with hidden upgrade fees

- Budget tools that only work on desktop

- Sketchy free apps with no reviews or brand trust

Stick with the ones we covered here — all are verified and highly rated.

Which Budgeting App Should You Choose?

| Need help with… | Use This App |

| Canceling forgotten bills | Rocket Money |

| Smart alerts + coaching | Empower |

| Deep budgeting and planning | YNAB |

You honestly can’t go wrong with any of these. But if you want the fastest way to stop wasting money, go with Rocket Money first.

Bonus: Download My Free Student Budget Tracker

Want to budget outside an app too? Grab my free Google Sheets template made just for students.

- Mobile and desktop compatible

- Includes auto-calculating budget tracker

Alt-text: Preview of student budget tracker in Google Sheets with expense categories

✅ Download the Free Budget Template Here

FAQ: Student Budgeting Apps 2025

Are these apps really free?

Yes! Rocket Money and Empower have free versions. YNAB offers a 34-day free trial.

Will this help me save money as a student?

100%. Even if you only cancel one unused subscription, you’re already ahead.

Can I use more than one app?

Absolutely — some students use Rocket Money for canceling bills + Empower for daily tracking.

Are these apps safe?

Yes — all three use 256-bit encryption and do not store your login details. Your data is as safe as your bank.

Do I need to link my bank account?

Yes, for automatic spend tracking. You can still use YNAB manually if preferred.

What’s the best budgeting app that’s 100% free?

Rocket Money and Empower offer free versions with no required upgrade — both are great for broke students starting out.

Try the best student budgeting apps 2025 to streamline your financial responsibilities.

Using the best student budgeting apps 2025 can help in managing bills and expenses effectively.

Final Thoughts

Budgeting doesn’t have to be boring. With the right tool, it can be fast, smart, and even a little fun.

Whether you want total control or a passive savings tool, there’s an app here that fits your style.

Here’s what real students are saying:

- “Rocket Money saved me $47 in under 20 minutes.”

- “Empower feels like a money coach in my pocket.”

- “YNAB finally helped me stop living paycheck to paycheck.”

If you’re ready to stop stressing about money and start saving right now:

✅ Download Rocket Money Free — Cancel Bills, Track Spending, Save Money

For effective financial management, explore the best student budgeting apps 2025 that fit your lifestyle.